Take a bow: Australian Chamber Orchestra’s 400-year-old cello to make its debut

When Timo-Veikko “Tipi” Valve takes the stage in Wollongong on Friday night, he will do so holding a cello made 400 years ago by one of Italy’s greatest luthiers.

The latest acquisition by the Australian Chamber Orchestra Instrument Fund, the Amati cello was bought last year for $US1 million ($1.4 million) from J&A Beare, a London-based fine instrument dealer. Valve, the ACO’s principal cellist, said the new instrument would add a powerful voice to the orchestra when it begins its national tour at Wollongong Town Hall with Claude Debussy’s Cello Sonata in arrangement by Jack Symonds. “The instruments we purchase are like the highest-paid opera singers of the world,” said Valve. “The Amati has an amazing power to it.”

Valve said he “met” the cello late last year. “In a way, it found us. We weren’t actively looking and we were stunned by its beauty, power and capabilities.” The Amati cello will be shared among the orchestra cellists, and Valve will also continue to play a Guarneri cello on permanent loan and donated to the orchestra by arts philanthropist Peter Weiss AO. The Amati is the third acquisition for the ACO Instrument Fund, a $5.5 million (US) managed investment fund with 33 wholesale clients. The fund acquired a Stradivarius violin in 2011 and a Guarneri violin in 2014. It invests in instruments from the “golden age” of instrument making – crafted in Italy during the 17th and 18th centuries. The fund’s unit price has risen from $1 to $1.40 (Australian) since it its inception in 2011.

Key supporters of the orchestra include high-profile Australian arts patrons and business figures including Peter Weiss and Sussan chief executive Naomi Milgrom. Initial investors of the instrument fund include Guido Belgiorno-Nettis, joint managing director of Transfield Holdings and chairman of the ACO. ACO Instrument Fund chairman Bill Best said since 2011 the fund had delivered a return of 5-6 per cent a year and he expected it to deliver returns in the longer term. “We rely on the collective wisdom of the musicians, and when we have capacity to acquire it, we will. We were keen to have a cello because it was an appropriate diversification of our portfolio,” he said.

The fund is intended to deliver long-term capital gains and its unitholders have only limited opportunities to withdraw their investment every three years. The fund is due to be terminated after 10 years, in 2021, unless more than 50 per cent of the unitholders vote to continue it. Mr Best said the fund did not have immediate plans to acquire another instrument, but a viola could be next on the agenda. “It’s a case-by-case exercise, which is financially responsible. There is a quite strong argument to look at a viola at some stage, but we felt we haven’t found the right instrument at the right time,” he said.

Reposted from an article in AFRWeekend (Australian Financial Review), May 5, 2017

More Articles

Drab, Inconspicuous, and Quiet No More

Washington, D.C.area pianist and choral conductor Sonya Subbayya Sutton is a passionate advocate of the work of women composers. Read about some of her favorite women composers and discover new chamber repertoire from her list.Read More ↗

Andrew Brush: An amateur cellist with a global reach

After ACMP’s modest beginnings nearly 80 years ago, ACMP has grown to have a global membership, and perhaps nobody embodies this boundary crossing more than Andrew Brush. With his cello in tow, he splits his time between his home in Columbus, Ohio, and Buenos Aires, with visits to Europe and Istanbul, where his wife is from. Along the way, he has developed diverse musical interests, with influences ranging from Argentina to Mali. We caught up with Andrew recently after he had returned to Columbus, where he serves as a member of the ACMP North American Outreach Council.Read More ↗

Befriending Performance Anxiety: simple tips for success

Performance anxiety is a universal experience, a survival mechanism that is hard-wired. Many of us react with shaky hands, lack of focus, shallow and fast breathing, rapid heart rate, and even feeling queasy. This is all perfectly natural - our protective sympathetic nervous system comes online to save us from danger, real or imaginary! Join Dr. Xenia Pestova Bennett for a free online webinar about managing performance anxiety on Thursday, October 30th at 6pm UK/Ireland time.Read More ↗

The Great American Play-In: ACMP and ACO

On Saturday, September 13 ACMP embarked on its first collaboration with the American Composers Orchestra (ACO). Together we organized a Play-In focused entirely on music by twentieth and twenty-first century American composers. Over the course of three hours, forty-five musicians discovered sixteen pieces or sets of pieces by a wide range of American composers, spanning from 1896 through 2025.Read More ↗

Just Play Concert: Exploring New Voices and Old Masters with the Tarka String Quartet

Thanks to a “Just Play” grant from ACMP, the Tarka String Quartet—Sue Soong and Julie Park on violin, Kevin Jim on viola, and Angus Davol on cello—recently shared a program in San Diego that reflected their passions: exploring new voices by women composers alongside the great works of the quartet tradition.Read More ↗

ACMP Members of the Month – October 2025

Playing in a regular string quartet is kind of like having a regular foursome in golf – everyone needs to be of roughly similar ability, and they also need to get along. When those two dynamics come together, the result can be a lasting chamber group that brings enduring friendships. Such is the case with our Members of the Month for October – Ruth Sklarsky, Barbara McIver, Ellen Henry and Kathy Lewis, residents of the Rochester, N.Y., area who have played in a string quartet for more than a decade. They got together and collectively answered a few questions about their musical journey.Read More ↗

ACMP Event: Meet Harumi Rhodes

Join ACMP’s Executive Director Stephanie Griffin on Saturday, November 1 at 2pm Eastern time for a lively discussion and Q and A with violinist Harumi Rhodes. Harumi is the daughter of two famous chamber musicians: Stephanie’s former viola teacher, Samuel Rhodes (Juilliard Quartet) and violinist Hiroko Yajima (Mannes Trio.) Find out more about Harumi’s early life in that celebrated chamber music milieu, and about her journey as she established her own career as the second violinist of the world-renowned Takács Quartet.Read More ↗

New guidelines for ACMP’s Workshop and Community Music Grant, deadline: October 24, 2025

ACMP's annual Chamber Music Workshop and Community Music grant cycle is open! Deadline: Friday, October 17. Read about the new guidelines and sign up for the Grant Information Session.Read More ↗

A weekend of music and renewal at Chautauqua

When you first set foot on the grounds of the Chautauqua Institution in southwestern New York, it’s easy to understand the lift in Arlene Hajinlian and Sonya Sutton’s voices when they speak about their summer homes, and why they would welcome a group of ACMP members for a weekend of music-making.Read More ↗

Optometrist by vocation, flutist by avocation

For someone who does not pay the rent as a musician, Pat Brown leads a full musical life with her flute. An optometrist by profession and a dedicated flutist, she has been a member of the Texas Medical Center Orchestra for more than 20 years, serving on the board and helping the group win national awards.Read More ↗

The Great American Play-In: Saturday, September 13 at Opera America

On Saturday, September 13 from 2 to 6pm, the American Composers Orchestra (ACO) and ACMP are hosting a fun and festive chamber music Play-In at Opera America (NYC), focused entirely on chamber music by twentieth-century and living American composers.Read More ↗

A professional pianist charts new musical paths with chamber music

When it comes to chamber music, ACMP pitches a big tent, from players just starting out to those rediscovering a passion for the music they played on their younger days. But ACMP’s membership also includes a thriving community of professionals — highly trained musicians who discover a community in ACMP that is hard to find elsewhere. Grace Shepard is one such professional living in South Florida and serving on ACMP’s North American Outreach Council.Read More ↗

How a cellist learned to love the viola, her way

Chicago-area cellist Ruth Rozen recounts her adventures with a vertical viola, opening the door to playing the inner voices in chamber music.Read More ↗

Tremendous Trivia Tunes: A Fundraiser for ACMP

Four members from DeKalb, Illinois tried a new method of fundraising for ACMP. They felt so grateful for ACMP's Home Coaching program and the wonderful teachers in our Coach Directory, that they came up with an innovative idea to give back to our community. They raised a little over $200.00, but the greatest part was how much fun they had doing it.Read More ↗

And the Play-Ins continued in June!

With ACMP's rapidly growing community of chamber musicians, Play-In season is never over! Read about two recent Play-Ins in June.Read More ↗

2025 News of Note Puzzle Contest Winner and Answers

Congratulations to bassoonist Jessi Vandagriff for winning this year's News of Note puzzle contest. And read more for the great puzzle answer reveal!Read More ↗

Member of the Month, July 2025: Cheryl Hite

The ranks of ACMP members are filled with professionals who began their college careers with the intent of pursuing music for a living, then for whatever reason moved into another career. Colorado-based violist Cheryl Hite is one of those musicians. A native of Detroit, she enrolled at Indiana University in the 1970s as a double major – biology and viola performance. Read her interview with ACMP Board Chair Bob Goetz.Read More ↗

The day my quartet played out of tune and almost got our host evicted

Chamber music can be a high stakes activity - play a bit out of tune, and your host could end up on the street. Read about one such close call in New York City.Read More ↗

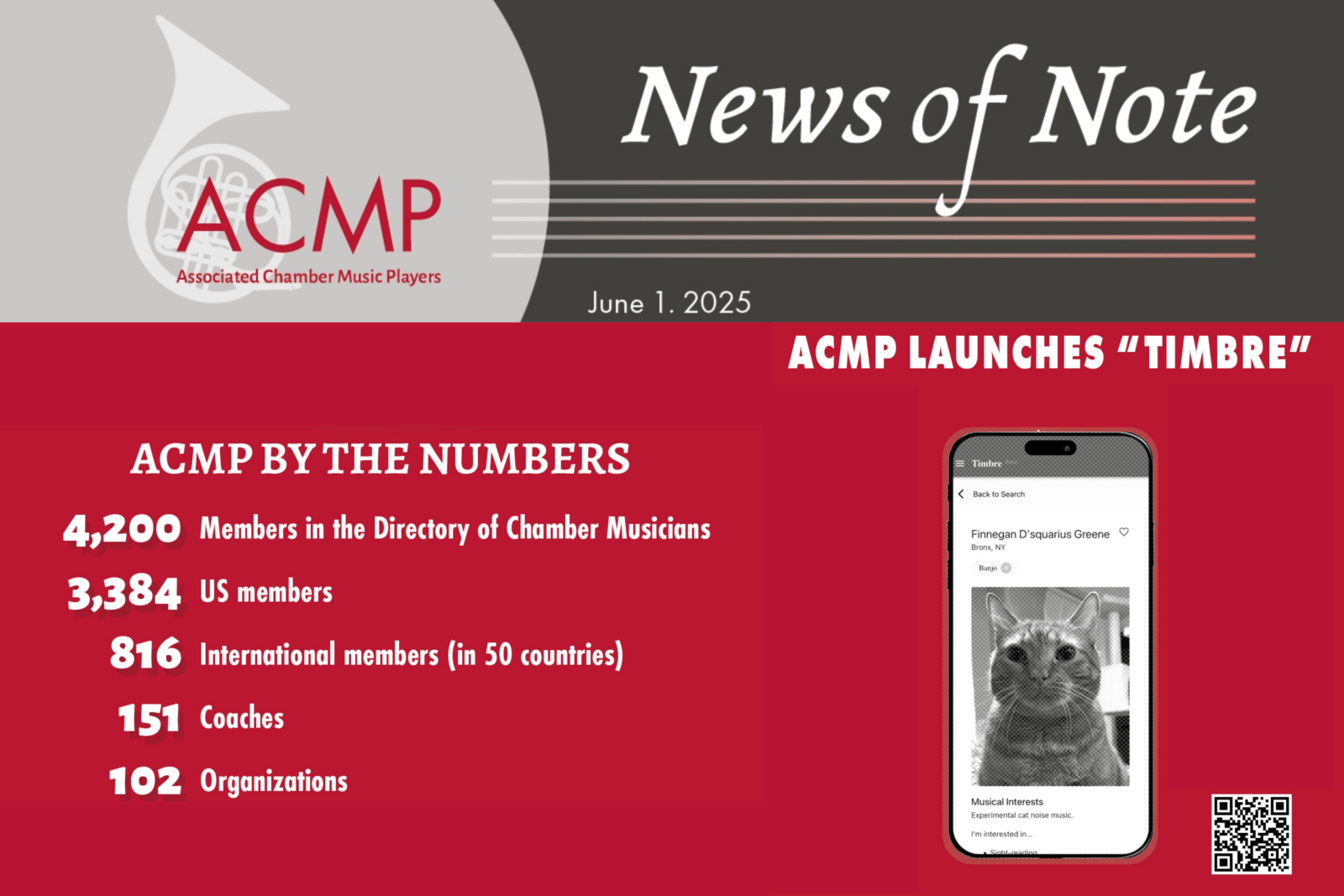

News of Note 2025

It’s that time of year again! The web version of the 2025 News of Note is live, featuring updates from the past year—and some fun extras, including everyone’s favorite: a new puzzle. (Submit your answers by July 1!)Read More ↗

Member of the Month, June 2025: Frank Song

Frank Song, 28, may work remotely as a software engineer, but when it comes to music and the arts, he is all about being there, in person. With the flexibility to travel in his work, he seeks out concerts or museum exhibits in cities far beyond his home in Toronto. And while he’s at it, he takes along his violin to play chamber music. We caught up with Frank on a recent visit to New York, where he played chamber music with people he found through ACMP.Read More ↗